Jan 23, 2025 ITOCHU Techno-Solutions Corporation

ITOCHU Techno-Solutions Corporation (headquartered in Minato-ku, Tokyo; Tatsushi Shingu, President and CEO; hereinafter "CTC") will start offering "C-NOAH," a service to use business applications and system platforms for financial institutions. Applications such as credit management and loan support and system platforms that comply with security standards in the financial industry will be provided as a SaaS service. This service will help streamline and advance business operations, while reducing initial costs for application development and infrastructure construction. We aim to achieve sales of 3 billion yen over the next three years.

Financial institutions, which manage large amounts of personal information and transaction data, are required to have systems and operational frameworks that meet strict security standards such as the FISC Guidelines*1 and PCI DSS*2. In order to achieve this, they need to have advanced expertise and organizational frameworks, as well as optimize costs.

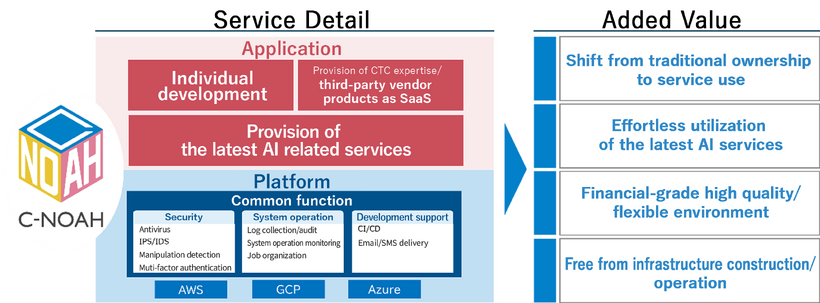

C-NOAH provides the necessary applications for financial institution operations and financial-grade infrastructure platforms as a cloud service. Customers can use the service on a monthly basis, billed according to the number of applications used and the usage of infrastructure platform, allowing them to quickly streamline and advance their operations while reducing initial costs for infrastructure platform construction and application development.

Customers can select and use applications they need from a range of credit management and loan business applications developed by CTC. Additionally, 10 types of AI modules, including AI meeting minutes generation and chat functions, are available, allowing customization and development of new applications tailored to customer operations.

The system platform can be selected from AWS, Azure, and GCP and also can be built as a multi-cloud combining multiple cloud services according to the purpose. Common services such as financial-grade security, system monitoring, and operational management are available. Additionally, if customers develop applications by themselves, they can use the system platform as a PaaS service.

This service also allows the use of relatively small generative AI models called Small Specialist Models (SSM), which are specialized for specific industries and domains. By combining multiple SSMs, customers can expect highly accurate responses tailored to their operations in tasks such as data extraction and risk analysis. Furthermore, the service also includes an "AI Agent" function that automatically selects optimal SSMs, allowing construction of systems that handle complex tasks according to the context, background, and situation of the dialogue, thereby supporting operational efficiency.

Based on our experience in building and operating robust and large-scale systems for the financial industry, CTC will continue to develop applications for other areas including credit risk management and anti-money laundering, contributing to further progress of digital transformation (DX) of customers in the financial sector.

Illustrative Image of C-NOAH

- *1 FISC guidelines: A standard to promote information security measures for systems in the financial industry established by FISC (The Center for Financial Industry Information Systems).

- *2 PCI DSS: A credit card industry security standard established by five international card brands.

Contact Information

ITOCHU Techno-Solutions Corporation, Corporate Communications Dept.

E-mail:press@ctc-g.co.jp

Currently displayed information is correct at the time of the announcement. Please be aware that information displayed may differ from the very latest information.