Aug 12, 2025 ITOCHU Techno-Solutions Corporation

ITOCHU Techno-Solutions Corporation (headquartered in Minato-ku, Tokyo; Tatsushi Shingu, President and CEO; hereinafter CTC) has launched the Financial Cybersecurity Guidelines Smart Check Service for financial institutions. Based on the Guidelines for Cybersecurity in the Financial Sector formulated by the Financial Services Agency *1 (hereinafter FSA Guidelines), this service checks and assesses the current state of customers’ cybersecurity posture and provides concrete countermeasure proposals from a technical perspective. We will offer the service to financial institutions and aim to secure 5 orders within the first year.

In recent years, cyberattacks targeting financial institutions have become increasingly sophisticated, leading to severe consequences such as information breaches and unauthorized fund transfers. The Financial Services Agency (FSA) formulated the FSA Guidelines to address these issues in October 2024, outlining 176 response items as cybersecurity measures or practices for financial institutions including governance, risk identification, defense and detection of cyberattacks, and third-party risk management. Checking the presence of all of them requires specialized security expertise and also needs sufficient time and organizational resources to evaluate and analyze their achievement status.

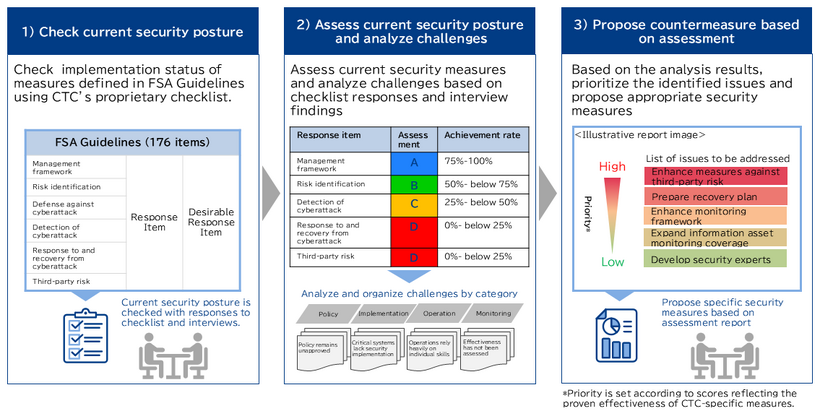

This service assesses the current state of customers’ cybersecurity measures using CTC’s proprietary checklist, which corresponds to the 176 items outlined in the FSA Guidelines. Based on the assessment results, CTC provides concrete countermeasure proposals to address identified issues.

With the CTC checklist, customers are asked single item questions included in one response item in the FSA Guidelines. By providing supplementary information such as interpretations of the Guidelines and guidance for answering, the checklist minimizes discrepancies caused by differing perspectives among respondents. In addition, based on the response results, the service analyzes the challenges of current security measures from the perspectives of “policy,” “implementation,” “operation,” and “monitoring,” and presents unaddressed items with assigned priorities. The easy-to-answer checklist allows assessment completions in approximately two months.

Furthermore, we can seamlessly support customers by proposing solutions to the challenges identified by this service, from selecting the right products and services to their implementation and operation, which is one of the key service benefits enabled by leveraging CTC's extensive experience and expertise.

Even financial institutions that have already conducted self-assessments based on the FSA Guidelines can also benefit from this service to systematically review their own initiatives and leverage the assessment results by CTC for future improvements.

CTC will continue to contribute to the stable system operation of our customers by expanding our services that support enterprises to enhance their security.

Flow of Financial Cybersecurity Guidelines Smart Check Service

- *1 The guidelines published by the Financial Services Agency in October 2024 that systematically organize the cybersecurity measures required of financial institutions and other entities in the financial sector. They consist of three sections: Section 1 “Fundamental Principles,” Section 2 “Cybersecurity Management Posture,” and Section 3 “Strengthening Cooperation between the Financial Services Agency and Related Organizations.” Specific response items are outlined in Section 2. The guidelines require financial institutions to build an effective and practical security posture tailored to their business environments and risk tolerance, rather than formerly complying with the guidelines.

Contact Information

ITOCHU Techno-Solutions Corporation, Corporate Communications Dept.

E-mail:press@ctc-g.co.jp

Currently displayed information is correct at the time of the announcement. Please be aware that information displayed may differ from the very latest information.